2025 Ira Contribution Limits Catch Up

2025 Ira Contribution Limits Catch Up. After a $500 increase to the ira annual limit in 2024, there was no change to next year’s limit. The irs determines the maximum contribution for each type of ira annually, and they recently announced the updated limits for tax year 2025.

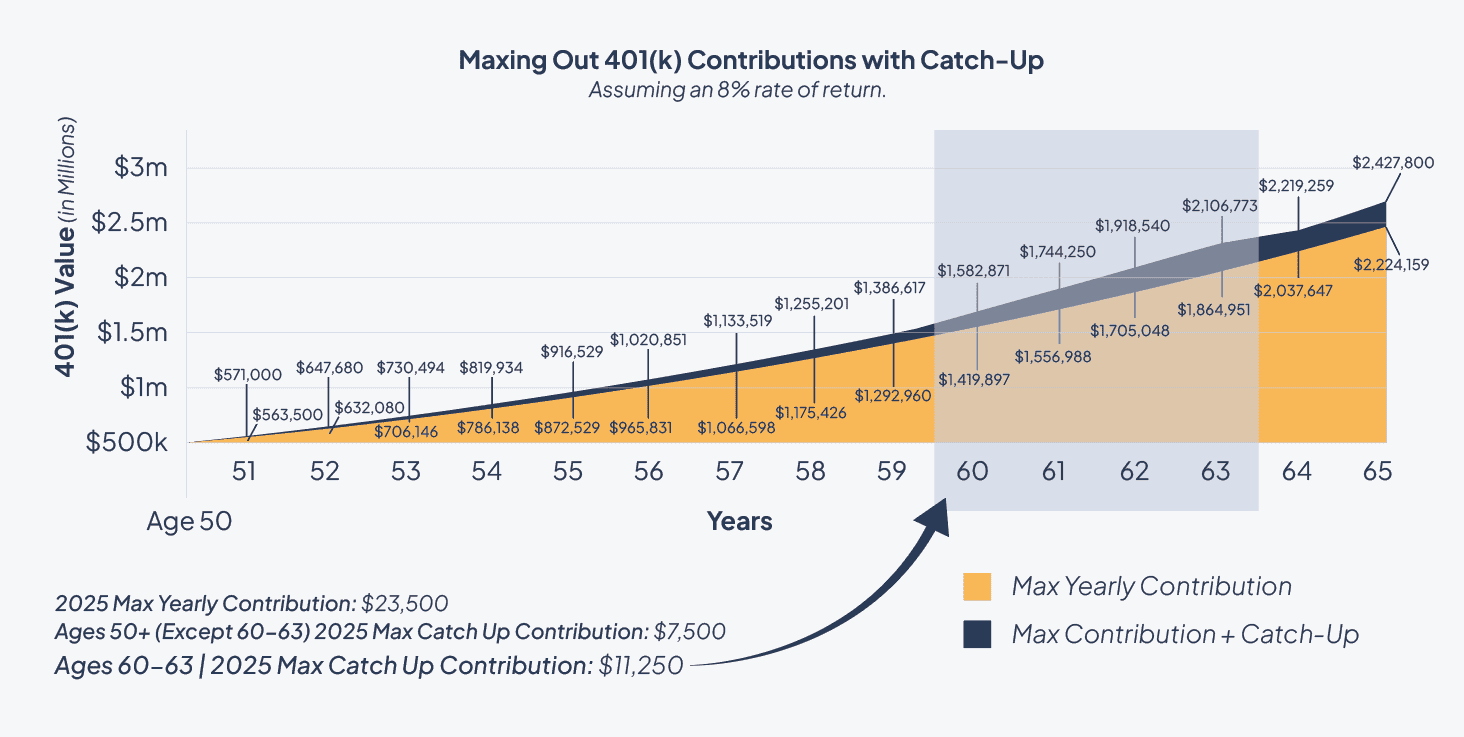

In 2025, the employee contribution limit for 401(k) and 403(b) plans increases to $23,500 for those under 50 (up from $23,000 in 2024). For 2025, the regular elective deferral limit increases to.

2025 Ira Contribution Limits Catch Up Images References :

Source: valmaaselorena.pages.dev

Source: valmaaselorena.pages.dev

Simple Ira Catch Up Contribution Limits 2025 Letta Lilian, If you intend to contribute to an individual retirement account in 2025, the maximum amount you can stash.

Source: carlyevmahalia.pages.dev

Source: carlyevmahalia.pages.dev

Ira Limit 2025 Brynn Sileas, You can contribute a maximum of $7,000.

Source: elsyvalberta.pages.dev

Source: elsyvalberta.pages.dev

401k Max Catch Up Contribution 2025 Babs Marian, Ira contribution limits remain largely unchanged for next year:

Source: ellenhjkanna-maria.pages.dev

Source: ellenhjkanna-maria.pages.dev

2025 Simple Ira Contribution Limits Over 50 Heidi Kristel, In 2025, the 401 (k) contribution limit for participants is increasing to $23,500, up from $23,000 in 2024.

Source: timforsyth.pages.dev

Source: timforsyth.pages.dev

2025 401k Limits And Matching Contributions Tim Forsyth, The irs determines the maximum contribution for each type of ira annually, and they recently announced the updated limits for tax year 2025.

Source: joseebsibbie.pages.dev

Source: joseebsibbie.pages.dev

Limits For Roth Ira Contributions 2025 Carley Sandra, If you’re 60 to 63, you can contribute an extra $11,250 max out employer contributions:

Source: www.modwm.com

Source: www.modwm.com

2025 401(k) and IRA Contribution Limits Modern Wealth Management, If you’re 60 to 63, you can contribute an extra $11,250 max out employer contributions:

Source: www.youtube.com

Source: www.youtube.com

Higher CatchUp Contribution Limits in 2025 YouTube, However, the irs will hold the ira annual contribution limits constant from 2024 to 2025 at $7,000.

Source: michaelbailey.pages.dev

Source: michaelbailey.pages.dev

Irs 401k Limit 2025 Catch Up Michael Bailey, In 2025, the employee contribution limit for 401(k) and 403(b) plans increases to $23,500 for those under 50 (up from $23,000 in 2024).

Source: michaelbailey.pages.dev

Source: michaelbailey.pages.dev

Irs 401k Limit 2025 Catch Up Michael Bailey, That means anyone who meets the age requirements can contribute a total of $31,000 to their.

Posted in 2025