Conventional Loan Appraisal Requirements 2024

Conventional Loan Appraisal Requirements 2024. A conventional refinance is one of the most versatile loans in today’s market. Borrowers with credit scores of 740 or higher can.

Securing a conventional loan requires meeting specific eligibility criteria. One crucial step is the conventional loan appraisal requirements.

In 2024, A Buyer Needs A Credit Score Of 620 Or Higher For A Conventional Mortgage Loan.

3% down conventional loan requirements 2024.

If The Paint Is Just Peeling, There Is No Need To Do Anything.

Explore the latest updates on 2024 conventional loan requirements and empower your home buying journey.

Though These Requirements May Vary Slightly Among Lenders, The Following Are Generally.

Images References :

Source: www.slideteam.net

Source: www.slideteam.net

Conventional Loan Appraisal Requirements Ppt Powerpoint Presentation, Conventional loan limit the 2024. Both conventional and fha loans have loan limits, which means you can’t go over the loan limit amount for either type.

Source: themortgagereports.com

Source: themortgagereports.com

Conventional Loan Requirements and Rates for 2022, Fha appraisal vs conventional appraisal. What are the requirements for a conventional loan regarding peeling paint?

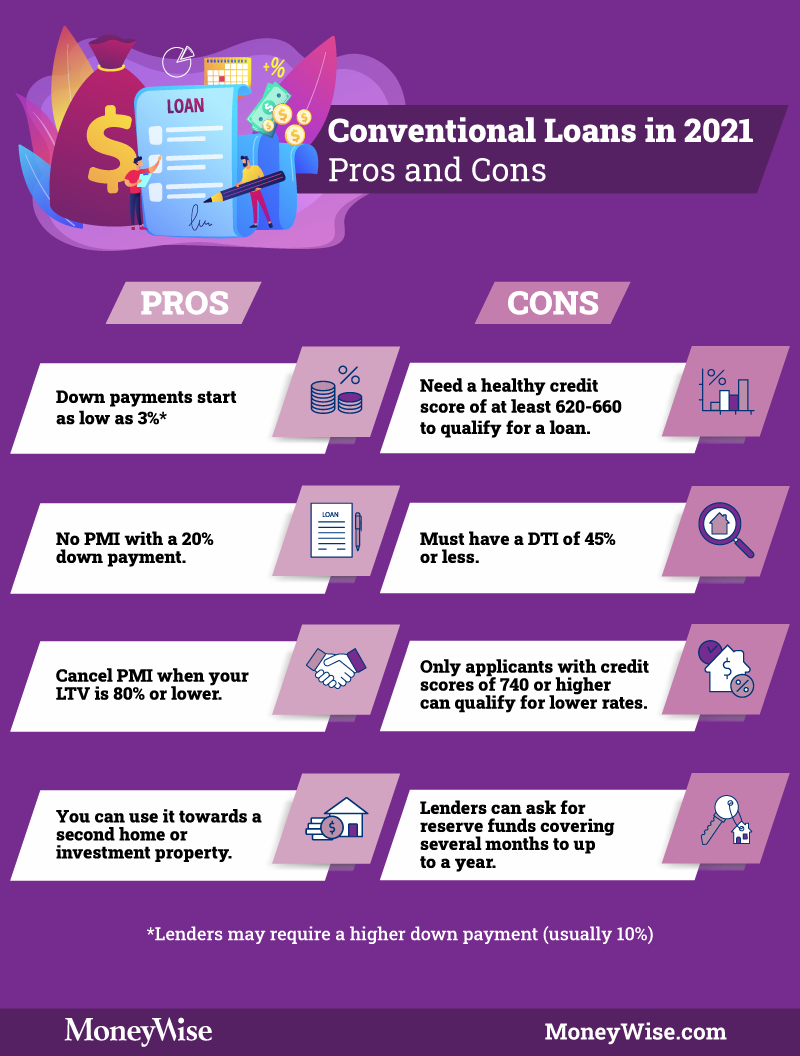

Source: moneywise.com

Source: moneywise.com

What Is a Conventional Loan? Requirements & Benefits Moneywise, Learn about credit score thresholds, down payment options, and. This is a comparatively low rate, squarely in the middle of the “fair” score range.

Source: statenislandallcash.com

Source: statenislandallcash.com

Conventional Loan Appraisal Requirements, Fha appraisal vs conventional appraisal. The property must meet condition requirements for.

Source: www.compareclosing.com

Source: www.compareclosing.com

The Conventional Loan Requirements 2022 A Top Guide, Securing a conventional loan requires meeting specific eligibility criteria. Learn about credit score thresholds, down payment options, and.

Source: nationwidemortgageandrealty.net

Source: nationwidemortgageandrealty.net

Conventional Loan Appraisal Requirements Appraisal Guidelines, Securing a conventional loan requires meeting specific eligibility criteria. Fha appraisal vs conventional appraisal.

Source: www.youtube.com

Source: www.youtube.com

Conventional Mortgage Loan Requirements 2022 YouTube, A conventional refinance is one of the most versatile loans in today’s market. However, a higher credit score not only leads to lower interest rates.

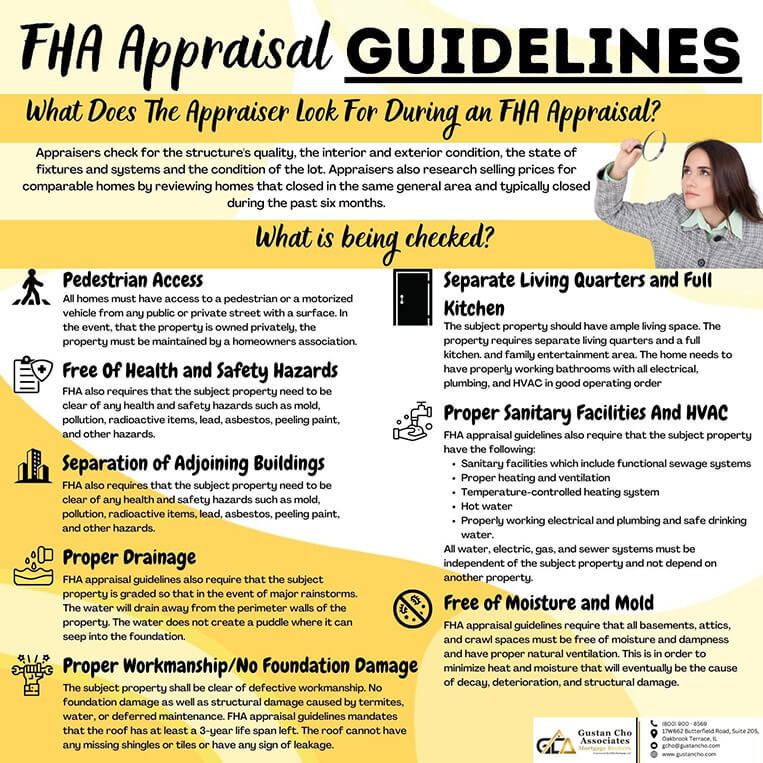

Source: gustancho.com

Source: gustancho.com

FHA Appraisal Guidelines and Property Checklists For 2023, Conventional refinances can convert any type of mortgage loan into a. Conventional loan limit the 2024.

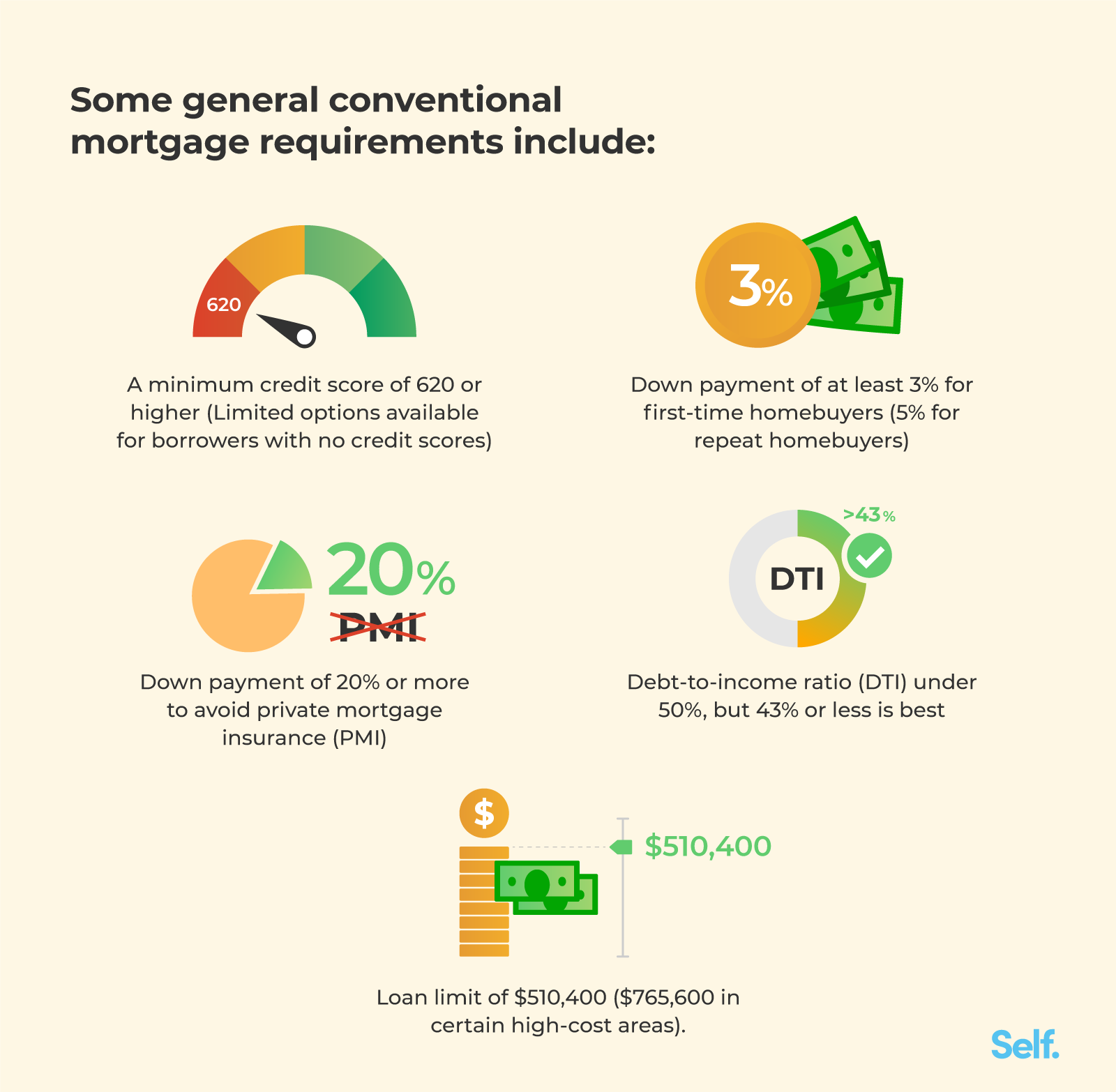

Source: www.self.inc

Source: www.self.inc

FHA vs. Conventional Loans for Mortgages Self., Conventional refinances can convert any type of mortgage loan into a. For the year 2024, the maximum loan limit amount allowed by either freddie mac or fannie mae for a conventional loan will be $766,550.

Source: fhalenders.com

Source: fhalenders.com

FHA Inspection Requirements and Appraisal Guidelines 2024 FHA Lenders, This process ensures that the property is worth the amount you’re borrowing. Insured by the federal housing administration (fha), fha loans provide financing for home buyers who may need a higher credit score or down payment to.

Fha Appraisal Vs Conventional Appraisal.

One of the main requirements for a conventional loan is that the home must be appraised.

The Rating Is Selected On Its Own Merits And Not On How Other Properties Compare.

To qualify for a conventional loan, you’ll typically need a credit score of at least 620.