Medicare Part D Premium 2024 Based On Income Tax

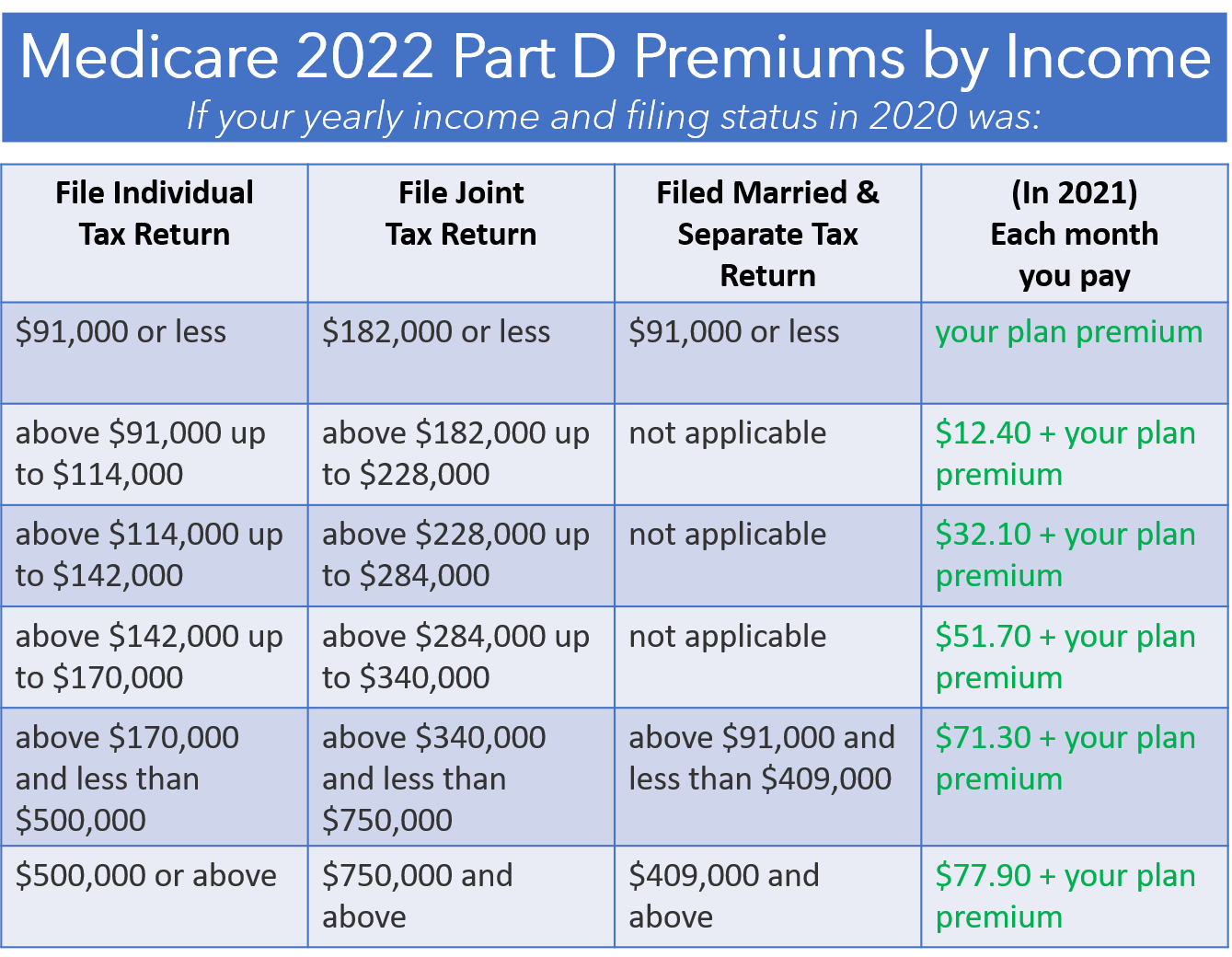

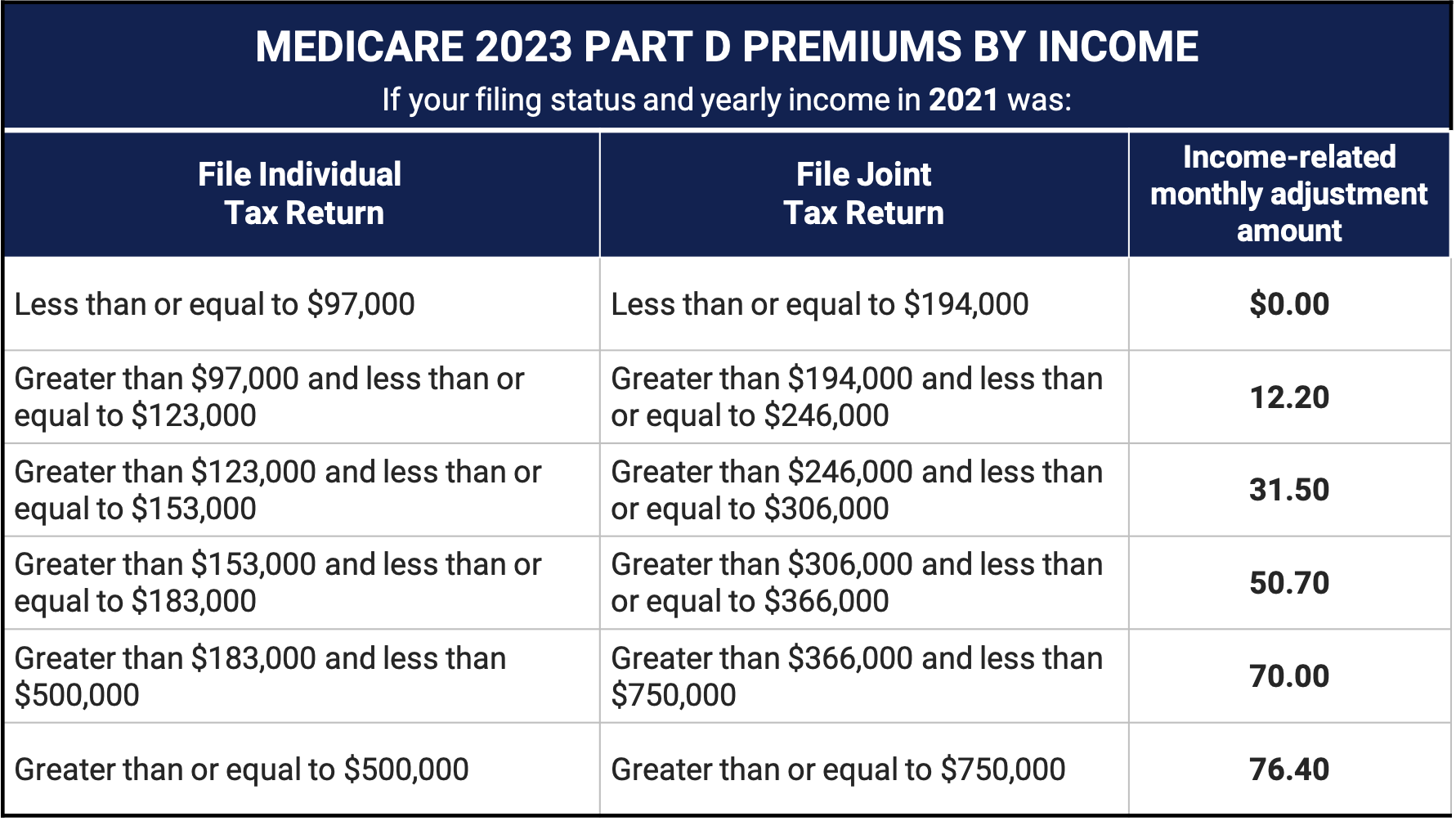

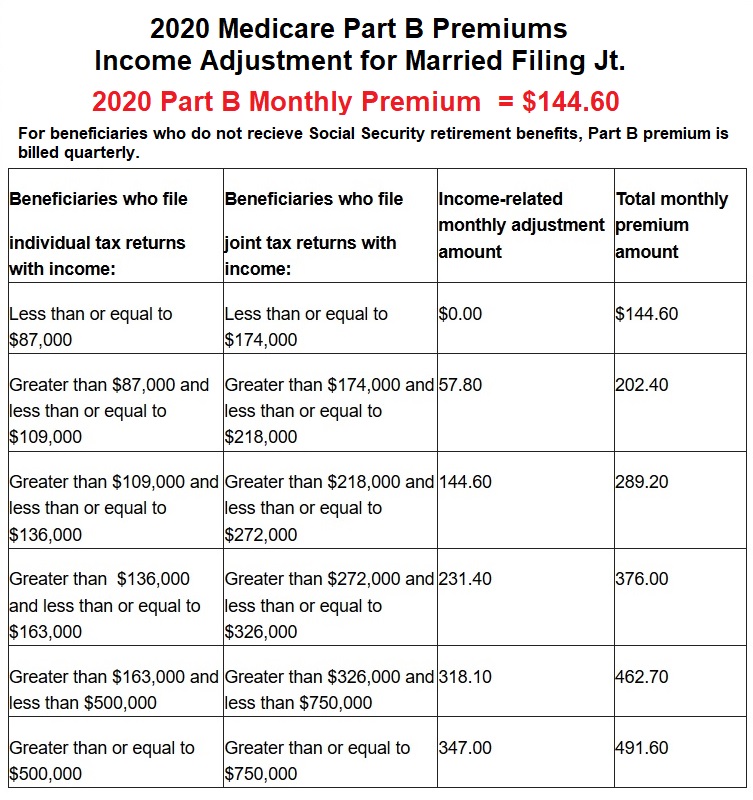

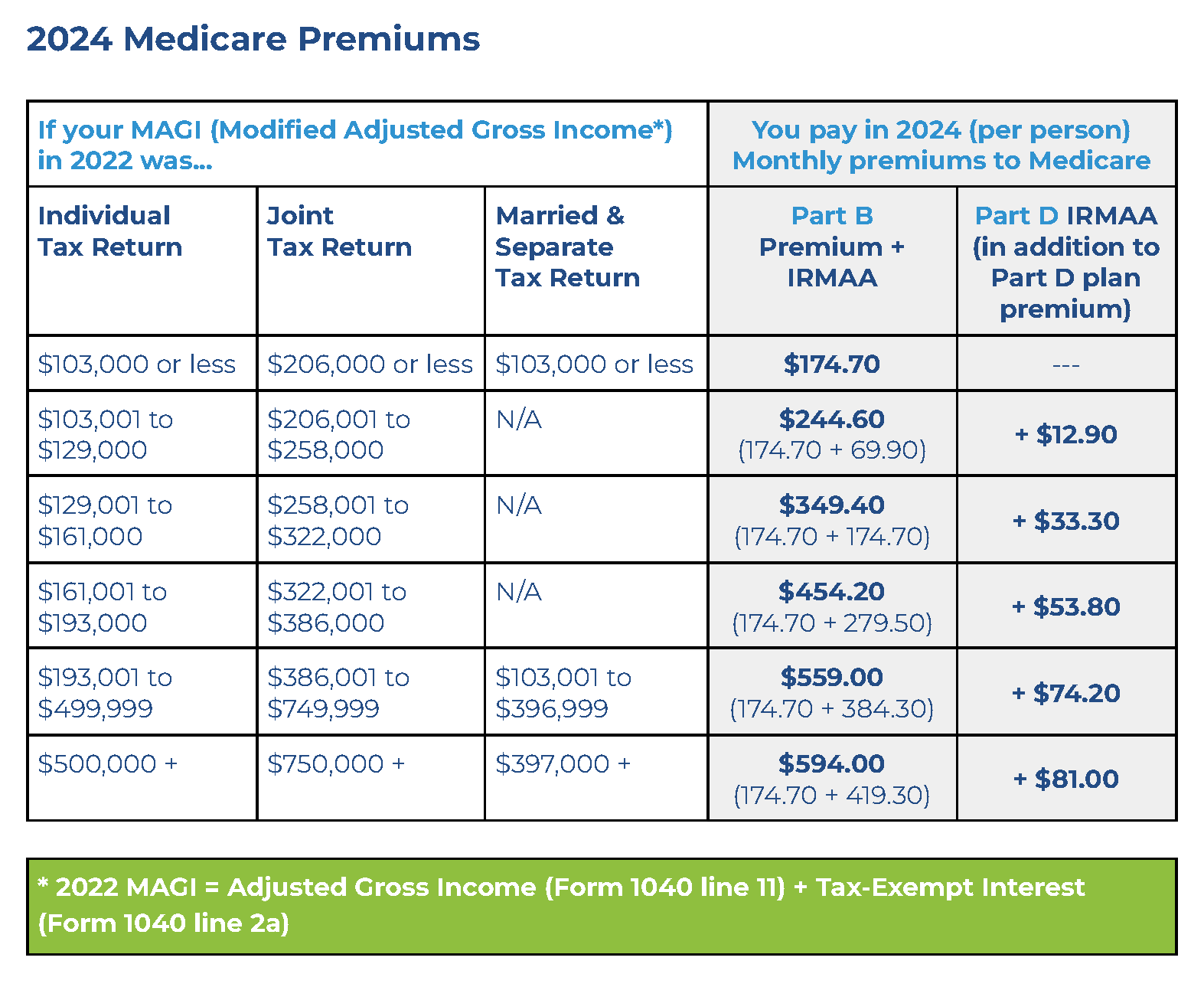

Medicare Part D Premium 2024 Based On Income Tax. Medicare beneficiaries with income over a set amount are required to pay a monthly fee in addition to their medicare part b and part d premiums. In 2024, no part d plan may have a deductible higher than $545.

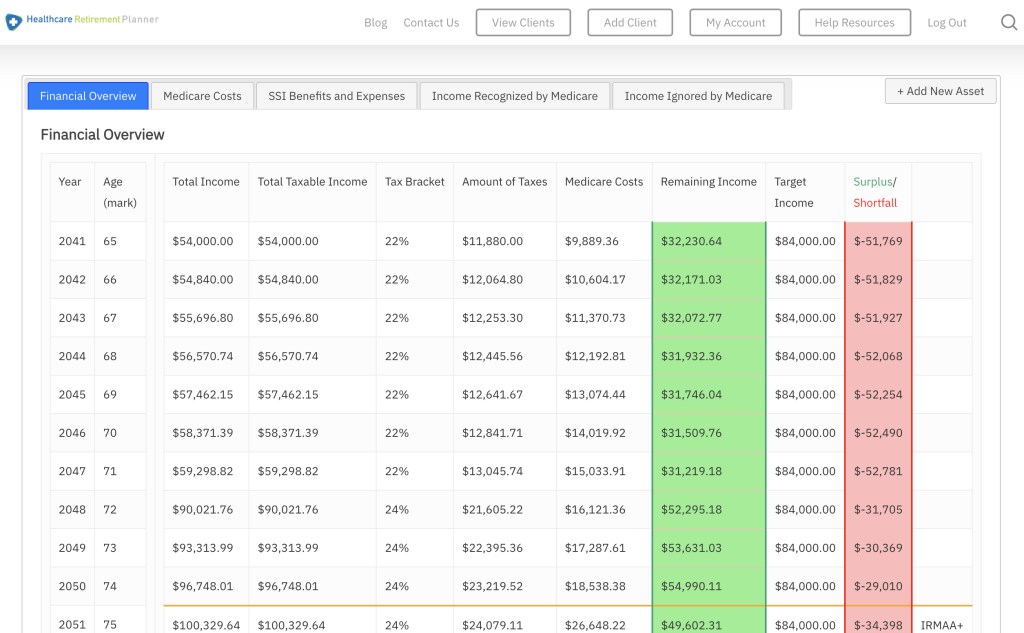

It impacts how much you pay for medicare part b and d premiums. The post below describes 2024 medicare part d premium and part b premium based on income.

Medicare Part D Premium 2024 Based On Income Tax Images References :

Source: zaharawkaren.pages.dev

Source: zaharawkaren.pages.dev

Medicare Part D Premium 2024 Projections Adara, The 2024 irmaa varies based on income.

Source: elizaqjuliana.pages.dev

Source: elizaqjuliana.pages.dev

Medicare Premiums Limits 2024 Twila Ingeberg, The average premium for part d, which covers drug costs, will be about $55.50 a month in 2024 down from $56.49 in 2023.

Source: zaharawkaren.pages.dev

Source: zaharawkaren.pages.dev

Medicare Part D Premium 2024 Projections Adara, The irmaa for part b and part d is calculated according to your income.

Source: zaharawkaren.pages.dev

Source: zaharawkaren.pages.dev

Medicare Part D Premium 2024 Projections Adara, The irmaa for part b and part d is calculated according to your income.

Source: www.healthcareretirementplanner.com

Source: www.healthcareretirementplanner.com

Navigating the Medicare 2024 IRMAA Brackets [UPDATED PREMIUMS, Medicare part d in 2024.

Source: jeanneymandie.pages.dev

Source: jeanneymandie.pages.dev

Medicare Limits 2024 Chart Pdf Licha Othilie, So, both your income and the part d plan you choose impact your monthly premium.

Source: karnaqrosabelle.pages.dev

Source: karnaqrosabelle.pages.dev

Medicare Monthly Premium 2024 Helyn Evangelin, Medicare part d provides prescription drug coverage.

Source: camiqchryste.pages.dev

Source: camiqchryste.pages.dev

What Are The Medicare Brackets For 2024 Lisa Sheree, What year is 2024 irmaa based on?

.png) Source: hollielaural.pages.dev

Source: hollielaural.pages.dev

Medicare Part D Irmaa 2024 Chart Chlo Conchita, For example, if your 2022 income was $102,000 (filing individual), your 2023 part d irmaa payment is an additional $12.20 per month and part b irmaa is $65.90.

Source: www.senior-advisors.com

Source: www.senior-advisors.com

Medicare Blog Moorestown, Cranford NJ, In 2024, no part d plan may have a deductible higher than $545.